What do the Patent Office Reports of Both Countries Reveal?

In 2024,

entrepreneurs in Poland and Ireland increasingly invested in protecting their brands (mainly, their names and logos) and the design of their products. Reports from the Patent Office of the Republic of Poland (UPRP) and the Intellectual Property Office of Ireland (IPOI) identify the fastest-growing industries and the dominant trends in trademark and industrial design filings.

The published data is a practical map for entrepreneurs who want to effectively protect their trademarks and the appearance of their products, enter new niches and succeed in foreign markets.

Poland

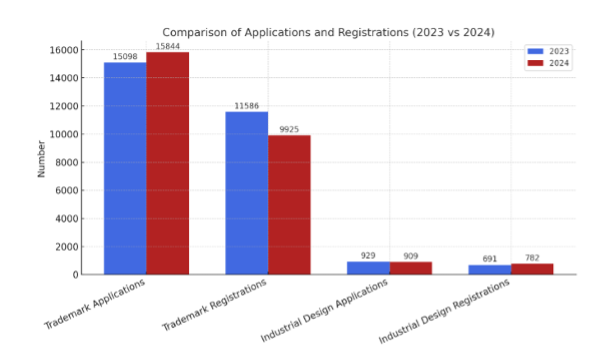

In 2024, 15,844 trademarks (including 14,356 filed with UPRP and 909 industrial designs (including 890 filed with the UPRP) were filed in Poland under both national and international procedures . Ultimately, only 9,925 trademark protection rights were granted (including 8,466 registered with the UPRP ) and 782 industrial design registrations (including 762 registered with the UPRP ). For comparison, in 2023, 15,098 trademarks were filed with the UPRP and internationally (including 13,434 with UPRP and 929 industrial designs (including 906 filed with UPRP). Ultimately, 11,586 trademark protection rights were granted (including 9,897 with the UPRP) and 691 industrial design registrations (including 668 with the UPRP).

Compared to 2023, the number of trademark applications increased by 4.9%, while the number of protection rights that were granted decreased by 1.7%. In the case of industrial designs, the number of applications decreased by 1.7%, and the number of registrations increased by 13.2%.

The number of EU applications filed by Polish entities at the European Union Intellectual Property Office decreased slightly, i.e. by 1.13%, although an increase of over 13% was recorded in Ireland.

In my view, awareness of the importance of brand protection among Polish entrepreneurs continues to grow, albeit at a rather moderate pace. The observed decline in the number of trademark protection rights granted by the Patent Office of the Republic of Poland is likely attributable to negative outcomes of formal examinations, while the number of oppositions filed has remained relatively stable (638 in 2024 compared to 665 in 2023). This trend underscores the importance of seeking professional advice in order to enhance the likelihood of a successful registration.

A stable number of industrial design applications, coupled with an increase in registrations, may indicate higher quality designs and the growing role of design in building a competitive advantage. Ireland

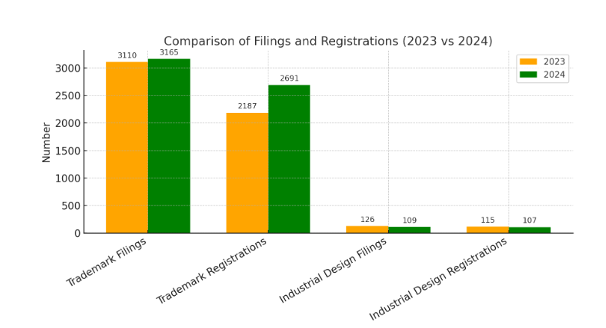

In 2024, 3,165 trademark applications were filed with the IPOI (including 2,336 national applications and 829 international applications designating Ireland). A total of 2,691 trademarks were registered (including 1,949 national applications). In addition, 51 applications were received, covering 109 industrial designs, of which 107 were registered by the end of the year.

In 2023, 3,110 trademarks were filed (including 2,218 national applications). A total of 2,187 trademarks were registered (including 1,220 national applications). In addition, 47 applications were received, covering 126 industrial designs, of which 115 were registered by the end of the year.

Compared to 2023, the total number of trademark applications increased slightly, by 1.8%, but registrations increased by as much as 23.0%. In contrast, the number of industrial design applications decreased by 13.5%, and registrations by 7.0%.

The 2024 report from the Intellectual Property Office of Ireland shows a modest increase in trademark applications, along with a notable rise in successful registrations. There was also an uptick in the number of oppositions filed (57 versus 27 the year before), which may indicate that applications are being prepared more carefully - often with help from professional representatives-- and by actively monitoring new filings to file oppositions on time, most often by competitors holding earlier trademark rights.

According to the IPOI Report, some businesses are choosing to register a European Union trademark instead of a national one, so they can protect their mark immediately in all 27 EU countries. The number of EUTM applications filed by Irish residents increased by a substantial 13%, from 1,351 in 2023 to 1 ,527 in 2024. Meanwhile, EU design applications filed by Irish residents decreased slightly, from 304 to 301.

The 13% increase in EU applications demonstrates the growing importance of brand protection at the international level. The decline in EU design applications and registrations suggests that Irish businesses are more focused on trademarks than on design protection.

Poland vs Ireland – the baseline of analysis

When comparing the Polish and Irish markets in terms of intellectual property, it is worth paying attention to the following points:

• Poland is approximately 4.45 times larger than Ireland in terms of land area .

• Poland has approximately 7.1 times more inhabitants than Ireland .

• Poland is on average 1.6 times more densely populated than Ireland.

• GDP per capita in Ireland is almost 4.8 times higher than in Poland.

• As of December 31, 2024, 245,699 trademarks are in force in Poland (including 173,139 national and 72,560 international trademarks (registers for these trademarks are maintained by the International Bureau of the World Intellectual Property Organization - WIPO) and 8,059 rights to industrial design registration (including 7, 734 national and 325 international).

• There are 68,844 trade marks in force in Ireland (including 49,188 national and 19,656 international) and 1,146 national industrial designs.

• In 2024, the WIPO Global Innovation Index (GII), which covers 133 economies and is based on approximately 80 indicators of innovation inputs and outputs, ranked Ireland 19th and Poland 40th. Both countries saw growth in both innovation inputs and outputs .

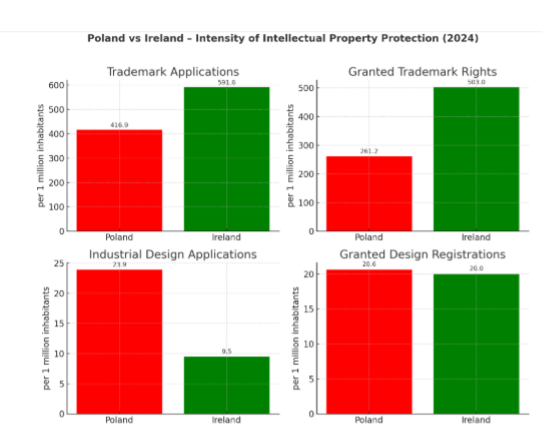

In 2024, Irish entrepreneurs applied for and registered trademarks more often per person than in Poland. This may reflect Ireland’s high level of innovation, strong new technology sector, and more developed business structure. For industrial designs, activity per person is similar in both countries, with a slight advantage for Poland.

Industries with the highest number of applications

1. Trademarks

In Poland, the leading sectors for trademark applications in 2024 included advertising and marketing services (4,533 applications), educational services (3,121), medical, cosmetic, and technical devices and instruments (1,994), scientific and technical research and services (1,702), and medical and veterinary services (1,444).

In Ireland, the highest number of applications related to educational services (432), followed by advertising and marketing services (385), medical, cosmetic, and technical devices and instruments (318), pharmaceutical products and dietary supplements (225), and paper, cardboard, and printed materials (211). Other significant categories include clothing and accessories, food products, and insurance and financial services.

The most active trademark applicants in Poland included both large manufacturing enterprises and service providers. The leader in terms of the number of applications was Delfarma Sp. z o.o. (46 applications), a Łódź-based pharmaceutical wholesaler specializing in parallel import. It was followed by Toruńskie Zakłady Materiałów Opatrunkowych S.A. (35 applications), a manufacturer of dressing materials and hygiene products; E. Grycan, M. Grycan Sp. j. (33 applications), a well-known confectionery brand; Dambat Jastrzębski S.K.A. (30 applications), a manufacturer of submersible pumps; and Telewizja Polsat Sp. z o.o. (24 applications), a leading national television broadcaster.

The largest number of trademark applications in Poland continued to originate from businesses based in the United States, China, and Switzerland, with an increase compared to the previous year. Notably, the number of applications from Ireland rose six-fold in 2024. The report of the Patent Office of the Republic of Poland provided significantly more detailed information, whereas the Intellectual Property Office of Ireland did not disclose comparable data in this area.

Conclusions

In both countries, applications from the advertising and marketing, education and medical and technical sectors dominate, confirming the crucial importance of IP protection in these sectors.

In Poland, the leaders are mainly large manufacturing and wholesale entities, striving to secure a broad portfolio of brands and products.

In Ireland, the structure of submissions is more diverse, with a strong emphasis on pharmaceuticals, dietary supplements and printed materials, reflecting its export and academic profile.<

2. Industrial designs

In Poland in 2024, industrial designs were most frequently registered for the following goods: furniture, lighting devices, packaging and containers for the transport and handling of goods, office supplies and equipment, for artists and teaching staff, and building and construction elements.

As for the goods for which industrial designs are registered in Ireland in 2024, these will be textiles, artificial and natural sheet materials, interior furnishings, packaging and containers for the transport or handling of goods, graphic symbols and logos, surface patterns, and ornaments.

Conclusions

In both countries, one of the main categories for which designs are registered is packaging and transport containers, reflecting the growing importance of logistics, e-commerce and visual brand identification.

In Poland, designs from the furniture, construction and lighting sectors predominate.

In Ireland, design in textiles and sheet materials has a significant presence, linked to the clothing, decoration and packaging industries.

Summary

Despite improving economic indicators in Poland and Ireland, 2024 remained a challenging year for businesses across the EU due to geopolitical tensions, supply chain disruptions, and ongoing armed conflicts. An analysis of reports from the Patent Office of the Republic of Poland and the Intellectual Property Office of Ireland confirms the growing importance of trademark and industrial design protection as integral elements of business strategy. Despite its smaller market size, Ireland demonstrates higher per capita activity in trademark registrations, reflecting its strong innovation capacity and the development of key sectors such as new technologies, pharmaceuticals, and financial services. Poland, on the other hand, continues to lead in industrial design applications, particularly in the furniture, construction, and lighting industries.

In both countries, trademark applications are dominated by businesses operating in the advertising and marketing, education, and medical and technical sectors. In the design category, applications are largely concentrated in packaging and other sectors specific to the local economy.

Poland is primarily focused on strengthening its position in the domestic market, while Ireland is intensifying its international activities, which can be seen particularly through the number of EU trademark applications.

Author: Natalia Basałaj

Attorney-at-law,

Hansberry Tomkiel Law Office

entrepreneurs in Poland and Ireland increasingly invested in protecting their brands (mainly, their names and logos) and the design of their products. Reports from the Patent Office of the Republic of Poland (UPRP) and the Intellectual Property Office of Ireland (IPOI) identify the fastest-growing industries and the dominant trends in trademark and industrial design filings.

The published data is a practical map for entrepreneurs who want to effectively protect their trademarks and the appearance of their products, enter new niches and succeed in foreign markets.

Poland

In 2024, 15,844 trademarks (including 14,356 filed with UPRP and 909 industrial designs (including 890 filed with the UPRP) were filed in Poland under both national and international procedures . Ultimately, only 9,925 trademark protection rights were granted (including 8,466 registered with the UPRP ) and 782 industrial design registrations (including 762 registered with the UPRP ). For comparison, in 2023, 15,098 trademarks were filed with the UPRP and internationally (including 13,434 with UPRP and 929 industrial designs (including 906 filed with UPRP). Ultimately, 11,586 trademark protection rights were granted (including 9,897 with the UPRP) and 691 industrial design registrations (including 668 with the UPRP).

Compared to 2023, the number of trademark applications increased by 4.9%, while the number of protection rights that were granted decreased by 1.7%. In the case of industrial designs, the number of applications decreased by 1.7%, and the number of registrations increased by 13.2%.

The number of EU applications filed by Polish entities at the European Union Intellectual Property Office decreased slightly, i.e. by 1.13%, although an increase of over 13% was recorded in Ireland.

In my view, awareness of the importance of brand protection among Polish entrepreneurs continues to grow, albeit at a rather moderate pace. The observed decline in the number of trademark protection rights granted by the Patent Office of the Republic of Poland is likely attributable to negative outcomes of formal examinations, while the number of oppositions filed has remained relatively stable (638 in 2024 compared to 665 in 2023). This trend underscores the importance of seeking professional advice in order to enhance the likelihood of a successful registration.

A stable number of industrial design applications, coupled with an increase in registrations, may indicate higher quality designs and the growing role of design in building a competitive advantage. Ireland

In 2024, 3,165 trademark applications were filed with the IPOI (including 2,336 national applications and 829 international applications designating Ireland). A total of 2,691 trademarks were registered (including 1,949 national applications). In addition, 51 applications were received, covering 109 industrial designs, of which 107 were registered by the end of the year.

In 2023, 3,110 trademarks were filed (including 2,218 national applications). A total of 2,187 trademarks were registered (including 1,220 national applications). In addition, 47 applications were received, covering 126 industrial designs, of which 115 were registered by the end of the year.

Compared to 2023, the total number of trademark applications increased slightly, by 1.8%, but registrations increased by as much as 23.0%. In contrast, the number of industrial design applications decreased by 13.5%, and registrations by 7.0%.

The 2024 report from the Intellectual Property Office of Ireland shows a modest increase in trademark applications, along with a notable rise in successful registrations. There was also an uptick in the number of oppositions filed (57 versus 27 the year before), which may indicate that applications are being prepared more carefully - often with help from professional representatives-- and by actively monitoring new filings to file oppositions on time, most often by competitors holding earlier trademark rights.

According to the IPOI Report, some businesses are choosing to register a European Union trademark instead of a national one, so they can protect their mark immediately in all 27 EU countries. The number of EUTM applications filed by Irish residents increased by a substantial 13%, from 1,351 in 2023 to 1 ,527 in 2024. Meanwhile, EU design applications filed by Irish residents decreased slightly, from 304 to 301.

The 13% increase in EU applications demonstrates the growing importance of brand protection at the international level. The decline in EU design applications and registrations suggests that Irish businesses are more focused on trademarks than on design protection.

Poland vs Ireland – the baseline of analysis

When comparing the Polish and Irish markets in terms of intellectual property, it is worth paying attention to the following points:

• Poland is approximately 4.45 times larger than Ireland in terms of land area .

• Poland has approximately 7.1 times more inhabitants than Ireland .

• Poland is on average 1.6 times more densely populated than Ireland.

• GDP per capita in Ireland is almost 4.8 times higher than in Poland.

• As of December 31, 2024, 245,699 trademarks are in force in Poland (including 173,139 national and 72,560 international trademarks (registers for these trademarks are maintained by the International Bureau of the World Intellectual Property Organization - WIPO) and 8,059 rights to industrial design registration (including 7, 734 national and 325 international).

• There are 68,844 trade marks in force in Ireland (including 49,188 national and 19,656 international) and 1,146 national industrial designs.

• In 2024, the WIPO Global Innovation Index (GII), which covers 133 economies and is based on approximately 80 indicators of innovation inputs and outputs, ranked Ireland 19th and Poland 40th. Both countries saw growth in both innovation inputs and outputs .

In 2024, Irish entrepreneurs applied for and registered trademarks more often per person than in Poland. This may reflect Ireland’s high level of innovation, strong new technology sector, and more developed business structure. For industrial designs, activity per person is similar in both countries, with a slight advantage for Poland.

Industries with the highest number of applications

1. Trademarks

In Poland, the leading sectors for trademark applications in 2024 included advertising and marketing services (4,533 applications), educational services (3,121), medical, cosmetic, and technical devices and instruments (1,994), scientific and technical research and services (1,702), and medical and veterinary services (1,444).

In Ireland, the highest number of applications related to educational services (432), followed by advertising and marketing services (385), medical, cosmetic, and technical devices and instruments (318), pharmaceutical products and dietary supplements (225), and paper, cardboard, and printed materials (211). Other significant categories include clothing and accessories, food products, and insurance and financial services.

The most active trademark applicants in Poland included both large manufacturing enterprises and service providers. The leader in terms of the number of applications was Delfarma Sp. z o.o. (46 applications), a Łódź-based pharmaceutical wholesaler specializing in parallel import. It was followed by Toruńskie Zakłady Materiałów Opatrunkowych S.A. (35 applications), a manufacturer of dressing materials and hygiene products; E. Grycan, M. Grycan Sp. j. (33 applications), a well-known confectionery brand; Dambat Jastrzębski S.K.A. (30 applications), a manufacturer of submersible pumps; and Telewizja Polsat Sp. z o.o. (24 applications), a leading national television broadcaster.

The largest number of trademark applications in Poland continued to originate from businesses based in the United States, China, and Switzerland, with an increase compared to the previous year. Notably, the number of applications from Ireland rose six-fold in 2024. The report of the Patent Office of the Republic of Poland provided significantly more detailed information, whereas the Intellectual Property Office of Ireland did not disclose comparable data in this area.

Conclusions

In both countries, applications from the advertising and marketing, education and medical and technical sectors dominate, confirming the crucial importance of IP protection in these sectors.

In Poland, the leaders are mainly large manufacturing and wholesale entities, striving to secure a broad portfolio of brands and products.

In Ireland, the structure of submissions is more diverse, with a strong emphasis on pharmaceuticals, dietary supplements and printed materials, reflecting its export and academic profile.<

2. Industrial designs

In Poland in 2024, industrial designs were most frequently registered for the following goods: furniture, lighting devices, packaging and containers for the transport and handling of goods, office supplies and equipment, for artists and teaching staff, and building and construction elements.

As for the goods for which industrial designs are registered in Ireland in 2024, these will be textiles, artificial and natural sheet materials, interior furnishings, packaging and containers for the transport or handling of goods, graphic symbols and logos, surface patterns, and ornaments.

Conclusions

In both countries, one of the main categories for which designs are registered is packaging and transport containers, reflecting the growing importance of logistics, e-commerce and visual brand identification.

In Poland, designs from the furniture, construction and lighting sectors predominate.

In Ireland, design in textiles and sheet materials has a significant presence, linked to the clothing, decoration and packaging industries.

Summary

Despite improving economic indicators in Poland and Ireland, 2024 remained a challenging year for businesses across the EU due to geopolitical tensions, supply chain disruptions, and ongoing armed conflicts. An analysis of reports from the Patent Office of the Republic of Poland and the Intellectual Property Office of Ireland confirms the growing importance of trademark and industrial design protection as integral elements of business strategy. Despite its smaller market size, Ireland demonstrates higher per capita activity in trademark registrations, reflecting its strong innovation capacity and the development of key sectors such as new technologies, pharmaceuticals, and financial services. Poland, on the other hand, continues to lead in industrial design applications, particularly in the furniture, construction, and lighting industries.

In both countries, trademark applications are dominated by businesses operating in the advertising and marketing, education, and medical and technical sectors. In the design category, applications are largely concentrated in packaging and other sectors specific to the local economy.

Poland is primarily focused on strengthening its position in the domestic market, while Ireland is intensifying its international activities, which can be seen particularly through the number of EU trademark applications.

Author: Natalia Basałaj

Attorney-at-law,

Hansberry Tomkiel Law Office